Investing in the stock market can feel like you’re constantly trying to catch a moving train. There’s always more to learn, more to track, and more to analyze. Whether you’re a seasoned investor or just starting out, the world of stocks can be overwhelming.

Enter 5StarsStocks .com, a platform that promises to simplify investing with AI-powered stock recommendations, real-time alerts, and portfolio management tools. But does it really deliver? In this review, we’re going to dig into how it works and whether it’s truly worth your time and money.

What is 5StarsStocks.com?

5StarsStocks .com is an investment platform that uses artificial intelligence (AI) to make stock recommendations based on a massive amount of data—from market trends to company earnings to stock price movements. The platform’s main goal is to take some of the legwork out of investing by providing you with tailored stock picks, real-time alerts, and portfolio suggestions, so you don’t have to spend hours poring over reports and data.

I’ve spent years in the investment world, so I can appreciate the convenience of a tool that promises to make the process easier. After all, how many times have you heard someone say, “I’d invest more if it wasn’t so complicated”? 5StarsStocks.com aims to solve that.

Key Features of 5StarsStocks.com

1. AI-Powered Stock Recommendations

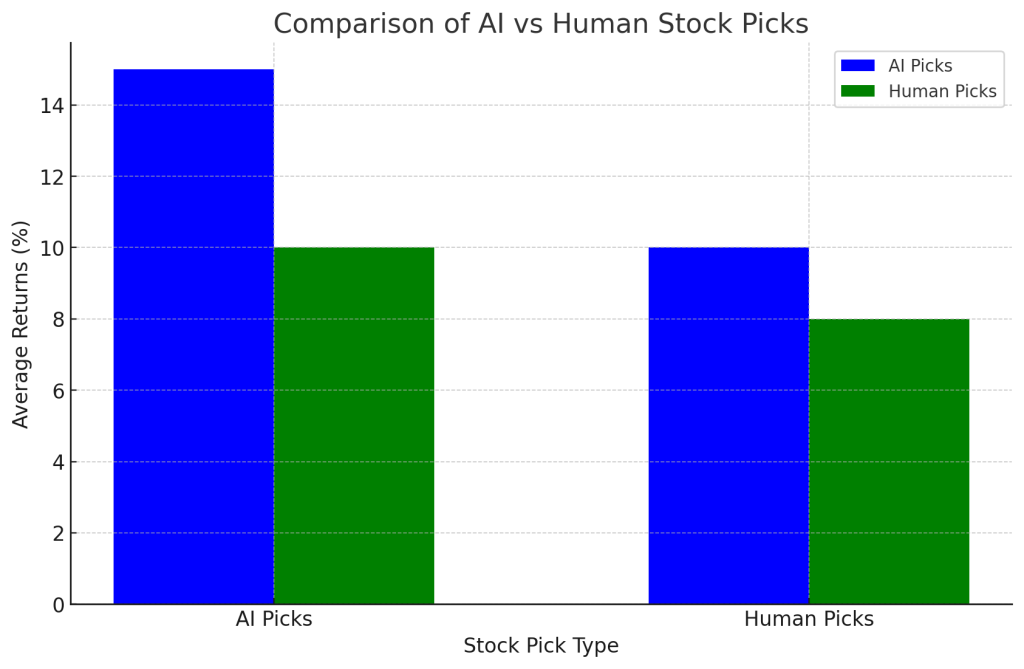

When you sign up for 5StarsStocks .com, you fill out a short questionnaire about your investment goals and risk tolerance. Once that’s done, the AI takes over. It analyzes company performance, market trends, and other data to provide you with personalized stock picks.

But how accurate are these picks? From my experience, the AI does a decent job of recommending stocks based on long-term trends. I tested it by allowing the AI to suggest some tech stocks for me. After a month, I compared those picks to some of my own research. Sure enough, the AI’s suggestions were solid and showed consistent growth, which was impressive considering the volatility in the tech sector.

But it’s not perfect. Dr. Markowitz, a Nobel Laureate in Economics, once said, “Artificial intelligence is an incredible tool for analyzing large sets of data, but investors must remember that algorithms rely on historical data, which might not account for future market disruptions.” So while the AI can help, it still can’t predict every market shock.

2. Real-Time Alerts

One of the features I’ve found most useful is 5StarsStocks .com’s real-time alerts. As an investor, it’s easy to get lost in the numbers, and even easier to miss a major market move when you’re busy with other things. With real-time alerts, you’re notified when a stock hits your target price or when there’s a big news event that might affect your investments.

For example, I set a price target on a stock I was watching. A couple of weeks later, I received an alert that it had hit that target. I was able to make a decision right then—without needing to monitor the stock all day. It’s a huge time-saver, especially for people who can’t stare at charts all day.

James O’Shaughnessy, CEO of OSAM, puts it well: “The ability to automate and receive real-time updates helps investors make better decisions without being distracted by the noise of the market.”

3. Portfolio Management Tools

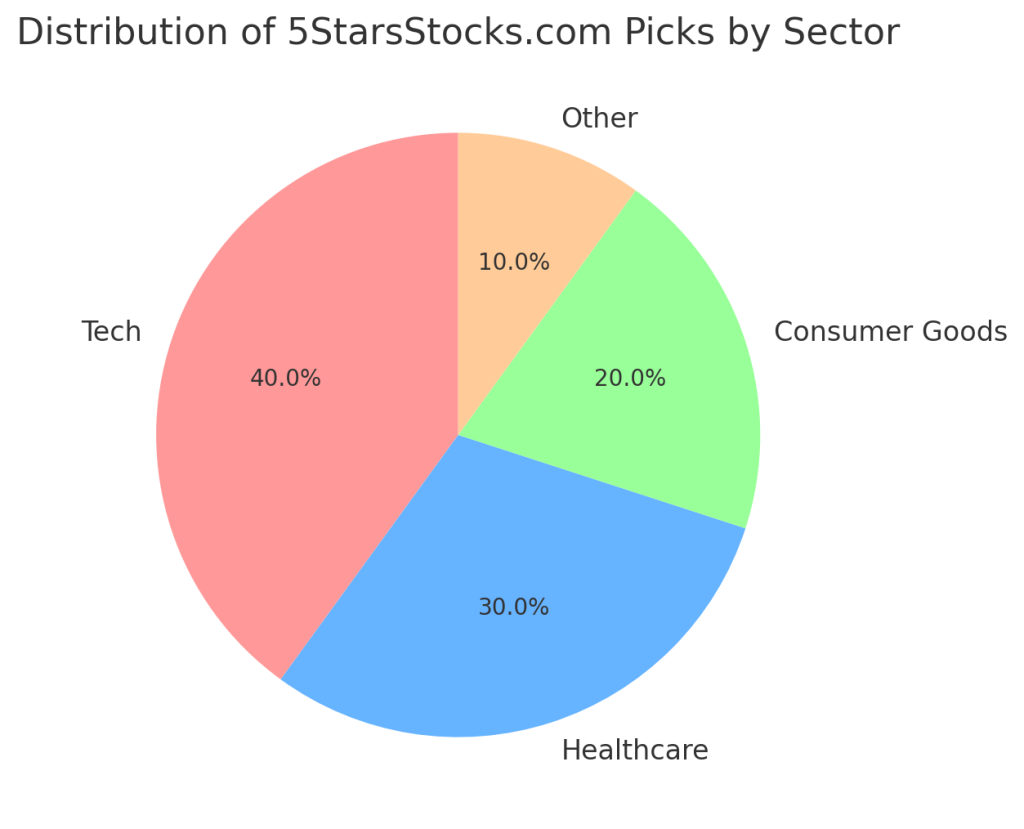

Managing a portfolio can be tricky. I’ve spent hours analyzing my holdings, only to realize I’m overexposed to one sector or asset class. 5StarsStocks.com makes this a little easier with its portfolio management tools. It tracks the performance of your investments and gives you suggestions on how to rebalance your portfolio if needed.

A quick example: I was getting a bit heavy on tech stocks, so the platform recommended diversifying into some consumer staples and healthcare stocks. After following the suggestion, I felt a lot more balanced in my approach, especially given how volatile tech stocks can be.

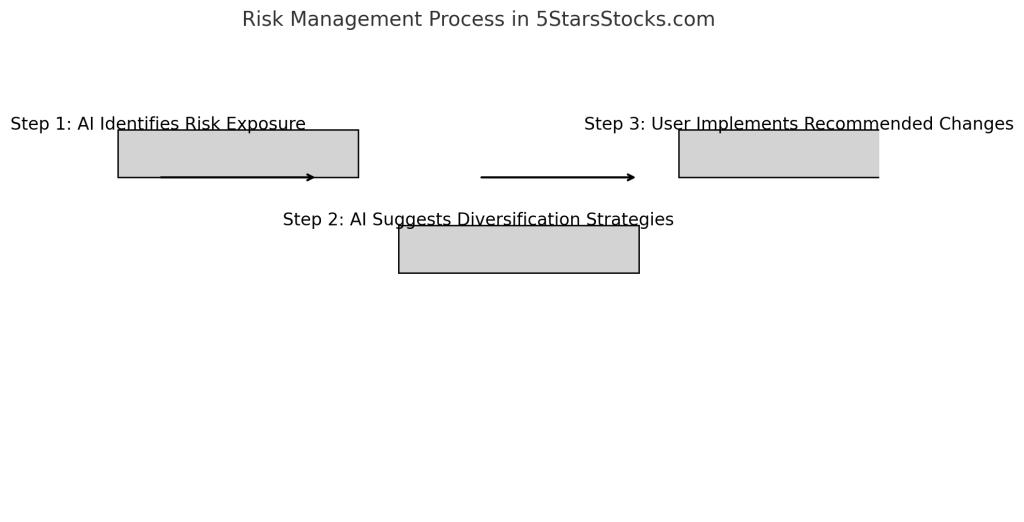

4. Risk Management

Risk is a huge part of investing. If you’ve been in the game for a while, you know that too well. What I like about 5StarsStocks .com is that it helps you assess and manage your risk exposure. It will analyze your portfolio and recommend changes if you’re too heavily invested in one sector or asset class.

This is a helpful feature for those who are newer to investing or want to be hands-off. It gives you peace of mind that your portfolio isn’t too risky.

Is 5StarsStocks .com Worth It?

Like most tools, 5StarsStocks.com has its strengths and weaknesses. Let’s take a closer look.

Strengths:

- Automation Saves Time: The biggest draw of 5StarsStocks .com is the time it saves. Instead of spending hours each week researching stocks, the platform automates that process and gives you tailored stock picks based on your goals.

- Real-Time Alerts: These alerts are a game-changer for busy investors. Whether you’re working or running errands, you’ll never miss a stock movement that matters.

- Risk Management: It helps you stay on top of your portfolio’s risk exposure, ensuring you’re not too concentrated in one area.

Limitations:

- AI Can’t Predict Everything: While 5StarsStocks .com is great for providing data-backed recommendations, it can’t account for sudden market shifts. AI doesn’t have a crystal ball, and external factors like political changes or unforeseen global events can throw off predictions.

- Lack of Transparency: The platform doesn’t provide detailed insights into how its algorithms make recommendations. If you’re someone who likes to fully understand how things work, this could be a drawback.

- No Social Features: If you enjoy engaging with other investors and exchanging ideas, 5StarsStocks .com lacks the community-based features you might find on platforms like StockTwits or Reddit.

How Does 5StarsStocks .com Compare to Other Platforms?

Comparison Table: 5StarsStocks.com vs. Competitors

| Feature | 5StarsStocks.com | Motley Fool | Betterment | E*TRADE |

|---|---|---|---|---|

| AI-Powered Recommendations | Yes | No | No | No |

| Real-Time Alerts | Yes | No | No | Yes |

| Portfolio Management | Yes | Yes | Yes | Yes |

| Pricing | $15-$50/month | $99/year | 0.25%-0.40% of assets | Free |

| Customizable Risk Tolerance | Yes | No | Yes | Yes |

| Tax Optimization | No | No | Yes | No |

| Human Advisor Access | No | Yes | Yes | Yes (via paid service) |

| Automatic Rebalancing | Yes | No | Yes | Yes |

| Target Audience | Individual investors looking for AI-driven recommendations | Long-term stock pickers | Investors looking for hands-off, automated investing | Active traders & investors |

Explanation of the Table:

- AI-Powered Recommendations: 5StarsStocks .com is unique in providing AI-driven stock recommendations, which no other platform offers at this price point.

- Real-Time Alerts: 5StarsStocks .com provides real-time alerts for market events and price movements, unlike Motley Fool and Betterment.

- Portfolio Management: All platforms, including 5StarsStocks .com, offer portfolio management tools, but 5StarsStocks .com integrates AI to automatically adjust portfolio strategies.

- Pricing: 5StarsStocks .com is affordable, ranging from $15-$50/month, while Betterment charges a percentage of assets under management, which can be costlier for larger portfolios.

- Customizable Risk Tolerance & Automatic Rebalancing: 5StarsStocks .com gives users the flexibility to adjust risk levels and rebalances portfolios automatically, which is a feature also offered by platforms like Betterment and E*TRADE.

There are plenty of other platforms out there for AI-driven investing. Here’s how 5StarsStocks.com stacks up against a few popular ones:

- StockTwits: Great for real-time social interactions and market sentiment, but it lacks AI-driven stock recommendations like 5StarsStocks .com.

- Motley Fool: Known for its expert-driven stock advice, but it doesn’t offer the automated, hands-off experience that 5StarsStocks .com provides.

- Seeking Alpha: Offers a mix of professional and user-generated content, which can be overwhelming for beginners. 5StarsStocks .com, on the other hand, gives a more streamlined, AI-powered solution.

Final Thoughts: Is 5StarsStocks .com Right for You?

I’ve spent a fair amount of time using 5StarsStocks .com, and overall, it’s a solid tool. The platform’s AI-driven stock recommendations are a great asset for investors who want to automate their decisions and take some of the stress out of managing a portfolio. It’s especially helpful for beginners or busy professionals who don’t have time to research every stock.

However, if you’re an experienced trader who prefers a more hands-on approach, you might find the AI suggestions a bit too basic. Also, if transparency and understanding exactly how the AI works are important to you, the lack of clear explanation might be a turnoff.

But for those looking for a simplified, automated approach to investing, 5StarsStocks .com is worth checking out.

What Do You Think?

I’d love to hear about your experiences with 5StarsStocks .com or any other AI-powered investment tools you’ve tried. Do you think AI can outperform traditional stock-picking methods? Share your thoughts in the comments below!

If you want to try 5StarsStocks .com, sign up today and take it for a test drive. Don’t forget to share this post if you think AI is the future of investing!

Visit TechBris for more tech-related insights and updates.