The world of investing is vast, but one of the most accessible and exciting areas to explore is fintech or financial technology. As the sector continues to grow, more investors are looking for ways to gain exposure to companies driving this transformation. One of the easiest ways to do this is through Exchange-Traded Funds (ETFs) focused on fintech.

In this article, we’ll explore what the FintechZoom.com ETF Market is, why it matters, and how you can approach it as an investor. This guide aims to provide you with practical and insightful information to help you make informed investment decisions.

What Is the FintechZoom.com ETF Market?

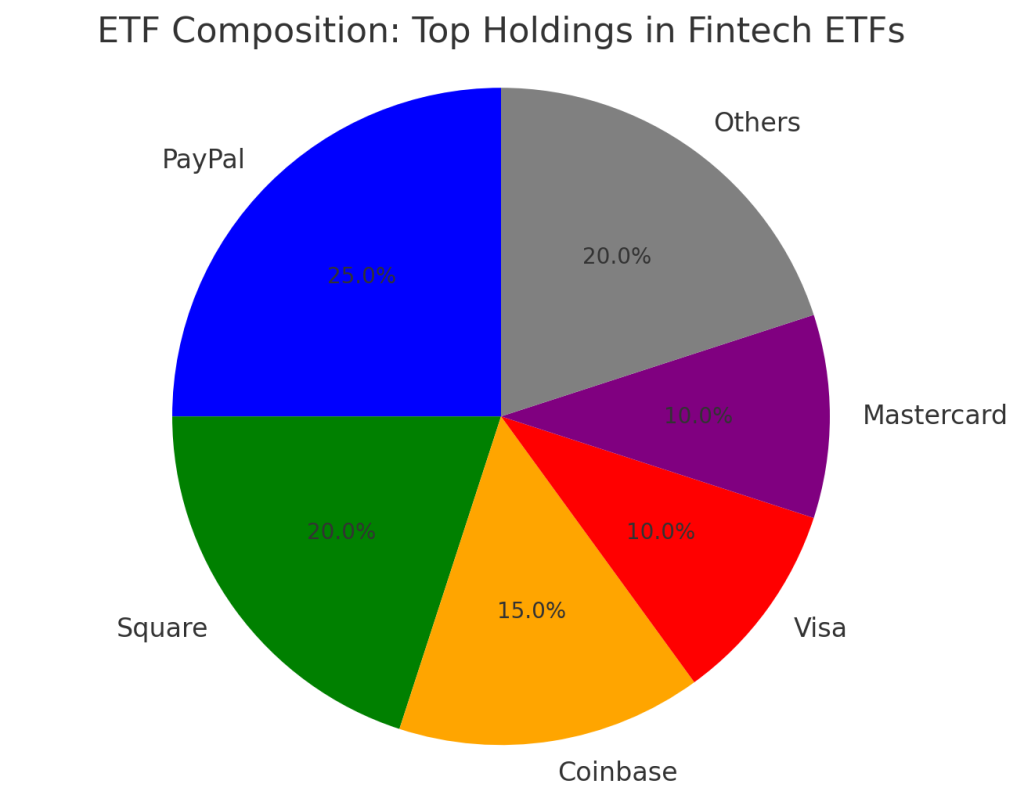

The FintechZoom.com ETF Market refers to the collection of ETFs that focus on companies involved in the fintech sector. Fintech is revolutionizing the way we handle financial transactions, manage investments, and interact with money. Companies in this sector include digital payment platforms (like PayPal and Square), blockchain companies (like Coinbase), and other innovators in areas like lending, investment management, and banking technology.

An ETF is a fund that holds a collection of assets—usually stocks—and trades on stock exchanges, much like individual stocks. Fintech ETFs allow investors to diversify their portfolios by giving them exposure to multiple fintech companies at once. Rather than investing in a single stock, fintech ETFs provide a way to access a broad range of companies shaping the future of finance.

Why Should You Care About the FintechZoom.com ETF Market?

1. The Fintech Industry Is Booming

The fintech industry is growing at an impressive rate, and for good reason. Technology is increasingly becoming a driving force in the financial sector. Traditional banking and financial services are being replaced by more efficient, innovative, and accessible digital solutions. For example:

- Digital Payments: Companies like PayPal and Square make it easier for consumers and businesses to send money digitally.

- Blockchain and Cryptocurrency: Coinbase, for instance, has created a platform where people can buy and sell cryptocurrencies like Bitcoin and Ethereum.

- Lending: Fintech platforms are also changing the way we think about loans. Companies like SoFi and LendingClub offer personal loans and student loans that are more accessible than traditional bank loans.

For investors, the growth of fintech presents a unique opportunity to capitalize on these shifts in the financial landscape. Fintech ETFs offer an easy way to invest in this rapidly expanding sector.

2. Diversification Without the Complexity

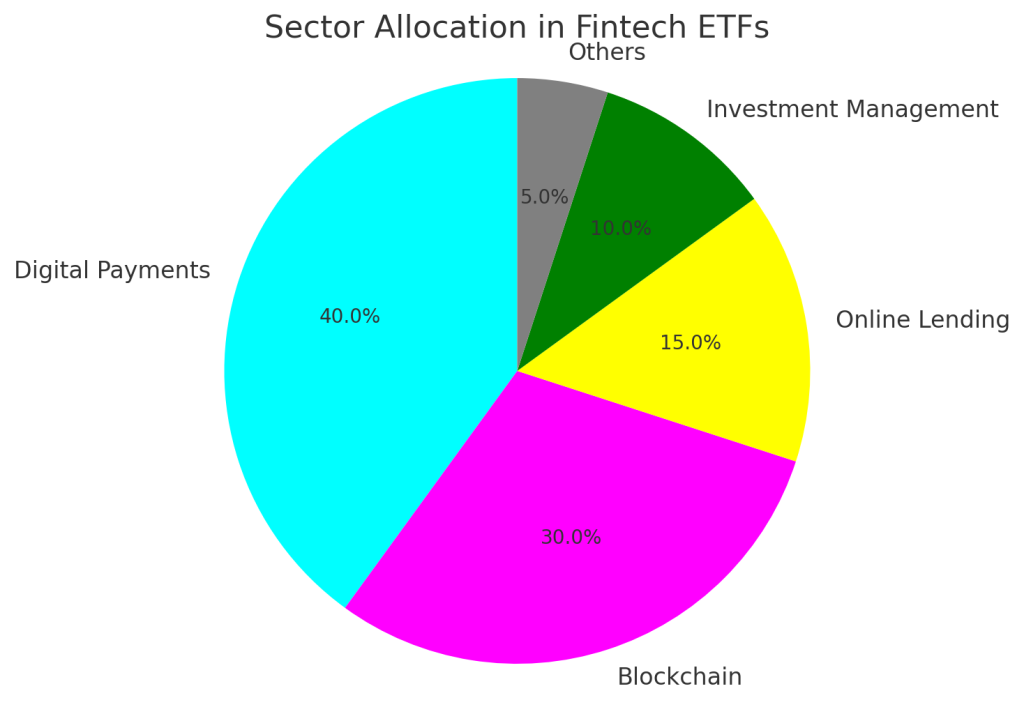

One of the main benefits of FintechZoom.com ETF Market is diversification. Instead of buying individual stocks in various fintech companies, you can invest in a single ETF that holds shares in many companies across the fintech space. This reduces the risk of relying too heavily on the performance of one company.

For example, a fintech ETF might include stocks from companies that focus on digital payments, blockchain, and lending. By investing in this ETF, you’re not only investing in one part of the fintech sector, but you’re gaining exposure to multiple sub-sectors that are all part of the broader financial technology revolution.

3. Access to Cutting-Edge Innovation

Fintech companies are at the forefront of technological innovation. For example, blockchain is a revolutionary technology that allows transactions to be securely verified and recorded without the need for intermediaries like banks. This technology has broad applications beyond just cryptocurrencies and is already being used in sectors like supply chain management, insurance, and healthcare.

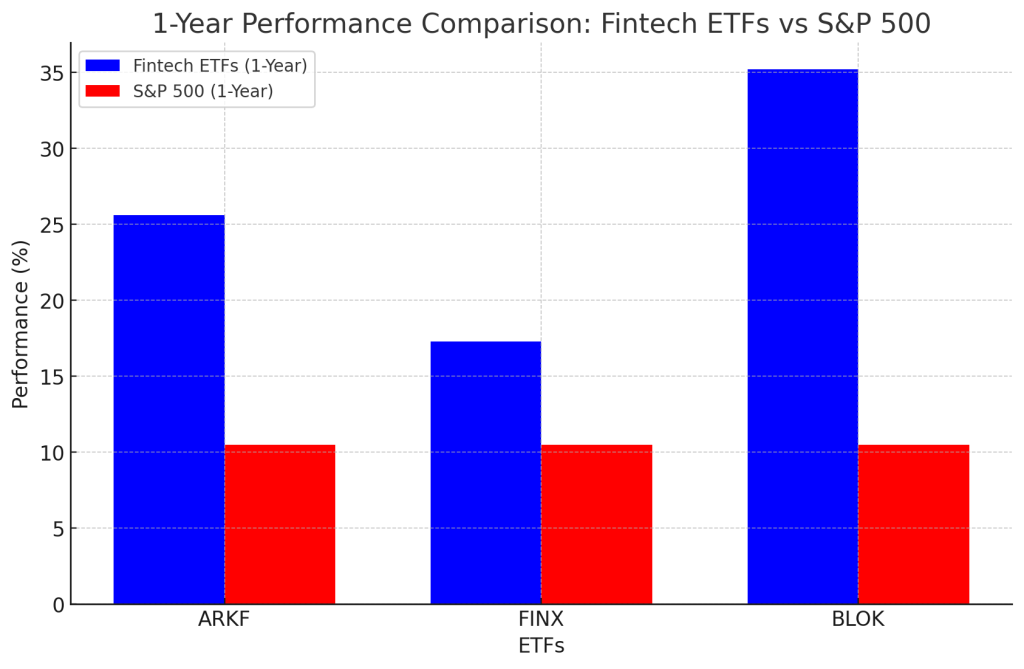

By investing in FintechZoom.com ETF Market, you’re putting your money into companies that are constantly innovating and disrupting traditional finance. This could lead to strong returns, especially if you invest in the right ETFs at the right time.

Popular Fintech ETFs You Should Know About

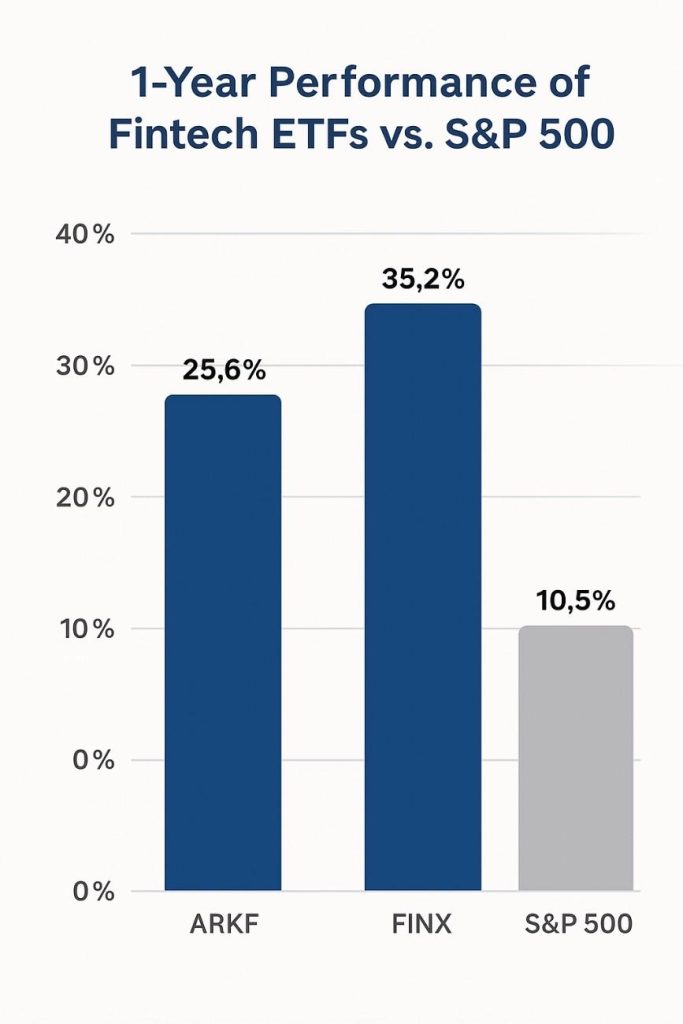

If you’re ready to dive into the FintechZoom.com ETF Market, there are a few ETFs that are particularly well-regarded by investors:

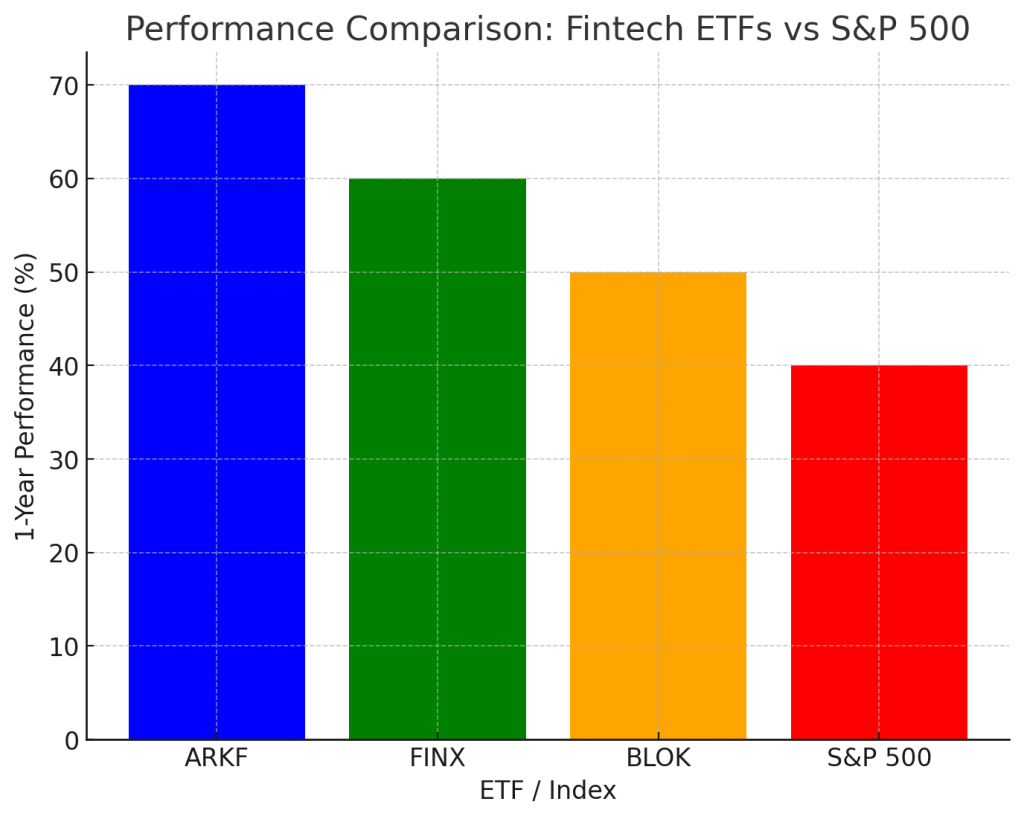

1. ARK Fintech Innovation ETF (ARKF)

Managed by ARK Invest, ARKF focuses on companies driving change in fintech. This ETF includes stocks from well-known fintech companies like Square, PayPal, and Shopify. ARKF is a good option if you want exposure to companies disrupting financial services through digital payments, blockchain technology, and e-commerce.

2. Global X FinTech ETF (FINX)

FINX is another popular option that provides exposure to companies at the forefront of fintech innovation. It includes stocks from Visa, Mastercard, and Alibaba—companies that are leaders in the digital payments space. If you’re looking for a broad, diversified approach to fintech, FINX is worth considering.

3. Amplify Transformational Data Sharing ETF (BLOK)

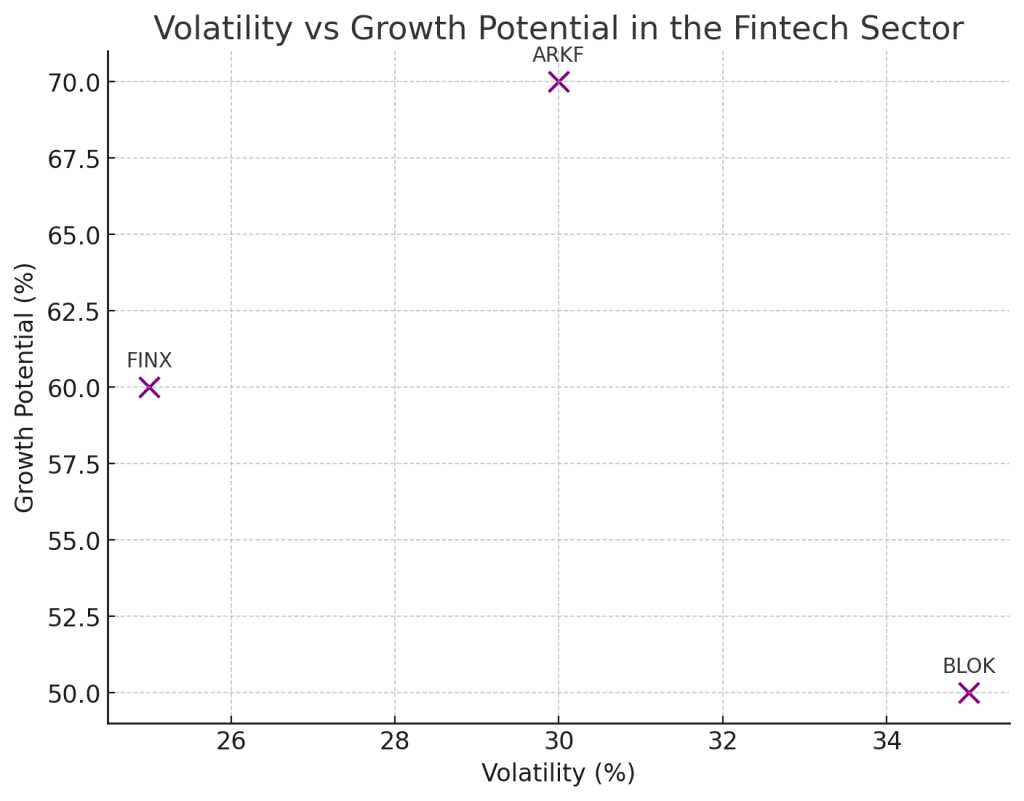

BLOK is an ETF that focuses on companies using blockchain technology to innovate and disrupt industries. The fund includes stocks from companies like Coinbase, Riot Blockchain, and MicroStrategy, all of which are directly involved in the cryptocurrency and blockchain space. If you’re particularly interested in blockchain technology, BLOK is a solid choice.

Key Risks to Keep in Mind

As with any investment, fintech ETFs come with their own set of risks. While the fintech sector has high growth potential, it’s also subject to volatility and regulatory changes. Here are a few risks to be aware of:

1. Regulatory Risk

Fintech companies, particularly those involved in cryptocurrencies, face significant regulatory scrutiny. Governments around the world are still figuring out how to regulate the fintech sector, especially in areas like digital currencies and data privacy. Regulatory changes could affect the performance of the companies in your ETF, so it’s important to stay updated on these developments.

2. Market Volatility

The fintech sector is relatively young and can be volatile. Stock prices for fintech companies can swing dramatically, especially for companies involved in newer technologies like blockchain and cryptocurrency. If you invest in FintechZoom.com ETF Market, be prepared for the possibility of short-term volatility.

3. Technological Disruption

Fintech companies are constantly innovating, but that also means they are vulnerable to disruption. A new technology or a competitor could emerge and change the landscape of the fintech sector, affecting the performance of the companies in your ETF.

Conclusion: Is the FintechZoom.com ETF Market Right for You?

Investing in FintechZoom.com ETF Market offers a straightforward way to gain exposure to the rapidly growing fintech sector. Whether you’re interested in digital payments, blockchain technology, or online lending, fintech ETFs allow you to invest in companies that are transforming finance as we know it.

However, like any investment, fintech ETFs come with risks, such as regulatory uncertainty, market volatility, and the fast pace of technological change. Before investing, make sure you fully understand the risks and rewards of the fintech sector.

If you’re ready to explore the opportunities in fintech, consider adding a fintech ETF to your portfolio. With the right research and a long-term view, fintech ETFs could provide the exposure you need to benefit from the future of finance.

Looking for more expert investment insights? Check out 5starstocks .com for top-rated stock recommendations and market trends.